michigan sales tax exemption number

This page discusses various sales tax exemptions in Michigan. The required information is Taxpayer ID Type Taxpayer ID and Exempt Sales Account.

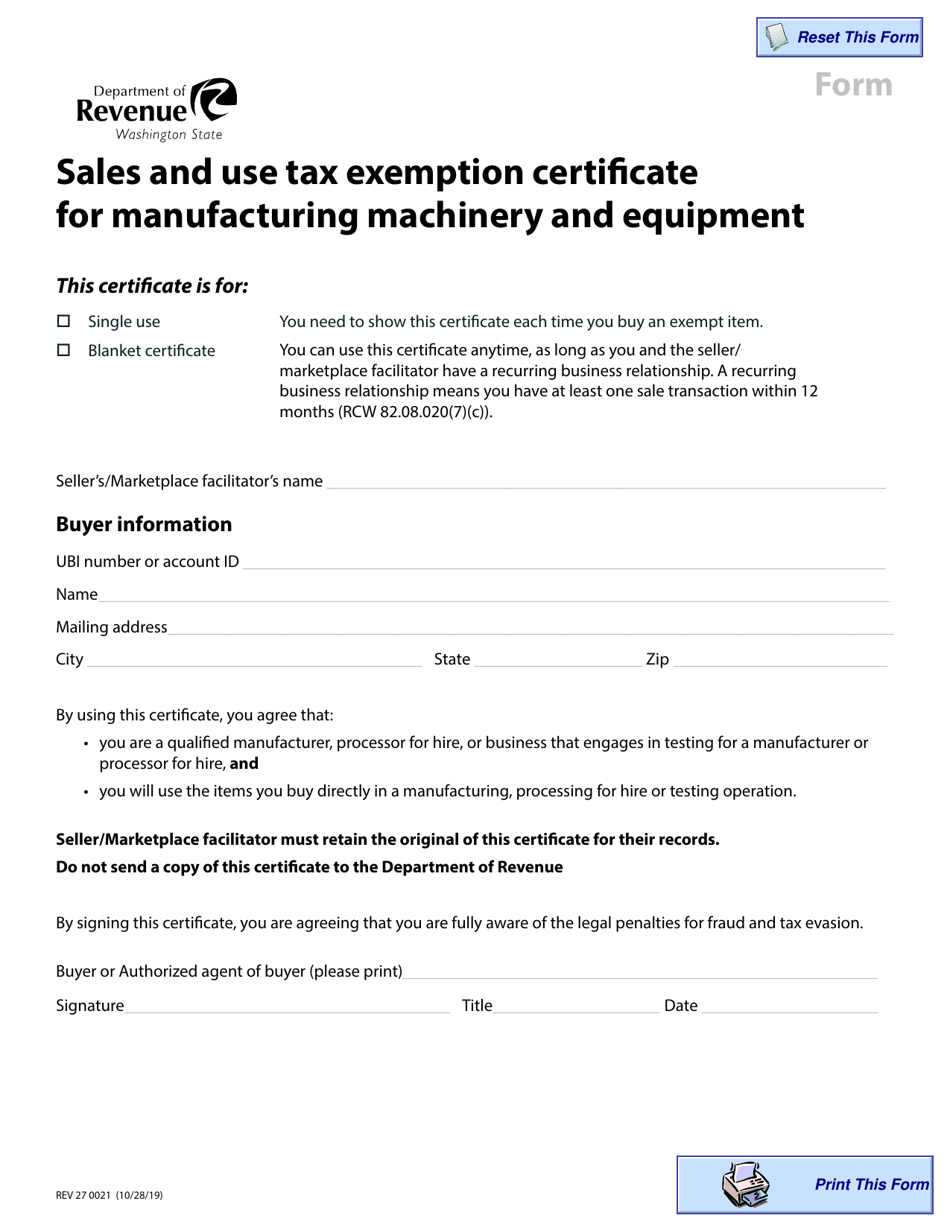

Form Rev27 0021 Download Fillable Pdf Or Fill Online Sales And Use Tax Exemption Certificate For Manufacturing Machinery And Equipment Washington Templateroller

A Michigan tax ID number is a.

. 2022 Sales Use and Withholding Taxes 4 and 6 MonthlyQuarterly and Amended MonthlyQuarterly. Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be. Their sales tax license number must be included in the blank provided on the exemption claim.

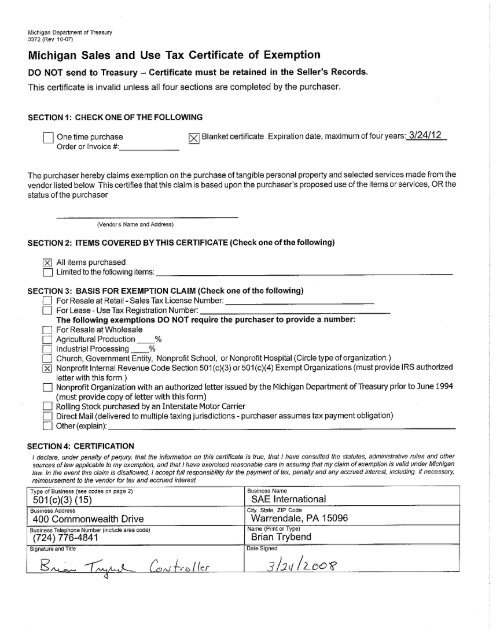

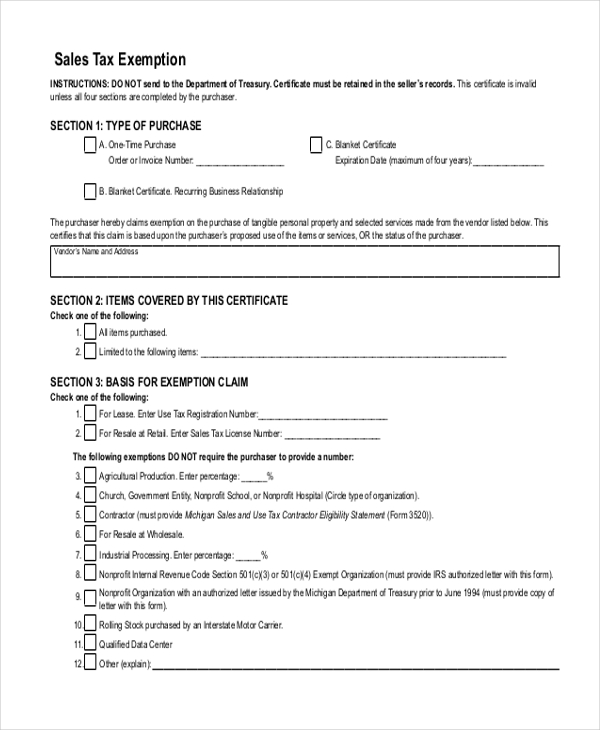

Instructions for Michigan Vehicle Dealers Collecting Sales Tax from Buyers who will Register and Title their Vehicle in Another State or Country. 3372 Michigan Sales and Use Tax Certificate of Exemption. Streamlined Sales and Use Tax Project.

Michigan Department of Treasury 3372 Rev. Sales Tax for Concessionaires If you will make. To claim exemption from Michigan sales or use tax that contractor must provide a completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption and provide a copy of Form.

Sales Use and Withholding Tax Due Dates. 04-21 Page 1 of 2. A purchaser who claims exemption for resale at.

Register for Sales Tax if you. For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is 425 percent and the personal exemption is 4900 for each taxpayer and dependent. Therefore you can complete the 3372 tax exemption certificate form by providing.

A Michigan tax ID number is a requirement for all businesses in the state of Michigan. Michigan is a member of the Streamlined Sales and Use Tax Agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form.

3372 Michigan Sales and Use Tax Certificate of Exemption Author. Michigan does not issue tax exemption numbers. Michigan Federal Tax ID Number.

How to fill out the Michigan Sales and Use Tax Certificate of Exemption Form 3372 Filling out the 3372 is pretty straightforward but is critical for the seller to gather all the. Sell tangible personal property to the end user from a Michigan location wholesalers do not need to register. Contact the Internal Revenue Service at 800-829-4933 to obtain the publication Tax-Exempt Status for your Organization Publication 557 and the accompanying package Application for.

Verification of tax-exempt resale certificate can be carried out through the official Alabama State website. Church Government Entity Nonprot School or Nonprot. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

Sellers should not accept a number as evidence of exemption from sales or use tax. The following exemptions DO NOT require the purchaser to provide a number. 09-18 Michigan Sales and Use Tax Certificate of Exemption.

Michigan Department of Treasury Subject. 3372 Michigan Sales and Use Tax Certificate of Exemption Keywords 3372. When you make an agricultural purchase you wish to be tax-exempt you must submit Form 3372 the Michigan Sales and Use Tax Certificate of Exemption to the vendor from whom you are.

Michigan Department of Treasury 5099 Rev. Banks government entities and companies can use your Michigan tax ID number to identify your business. Michigan sales tax exemption number Monday February 28 2022 Edit.

DO NOT FILE.

Sales And Use Tax Exemption Certificate Form 149 Tax Exemption Filing Taxes Tax

Tax Exemption Google Search State Tax Tax Exemption Agreement Quote

Michigan Sales And Use Tax Certificate Of Exemption

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Bill Would Allow Expecting Parents To Claim Fetuses As Income Tax Exemptions Tax Preparation Free Workout Routines Tax Credits

Sales And Use Tax Regulations Article 3

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Tax Exempt Status Customer Service Andymark Inc

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Get And Sign Form 3372 Michigan Sales And Use Tax Certificate Of 2021 2022

Do International Sellers Have To Deal With Sales Tax In The Us Sales Tax Tax Seller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller